Press Release

|July 22,2024PropNex's Survey Of HDB Flat Owners Shows That Nearly Five In 10 Respondents Aspire To Upgrade From Their Existing Flat; High Home Prices And ABSD Seen As Key Challenges To Upgrading

Share this article:

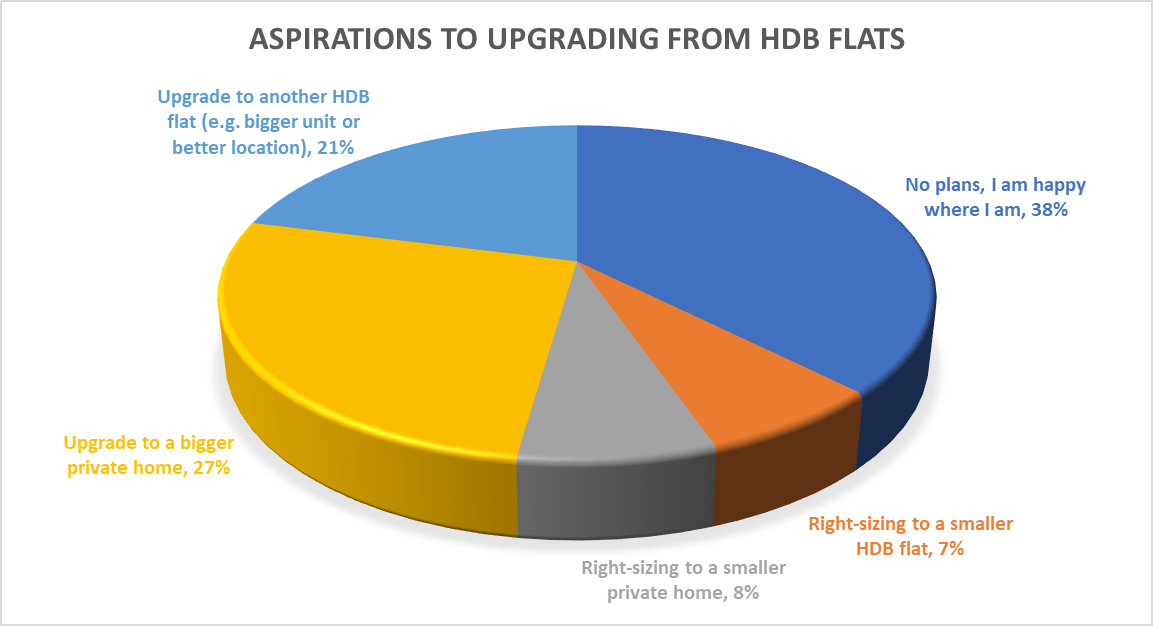

22 July 2024, Singapore - A survey of nearly 1,250 HDB flat owners by PropNex found that about 48% of the respondents aspire to upgrade from their existing public housing flat to either a larger HDB flat or a larger private residential property. Specifically, 21% of them indicated that they wish to move to a bigger HDB flat, while 27% of the respondents hope to upgrade to a larger private home. Meanwhile, more than a third of those polled said they have no plans to move, while the rest aspire to right-size to a smaller home (see Chart 1).

The poll was conducted by PropNex Research from mid-March to April 2024 to better understand the housing needs of HDB flat owners, their attitudes towards upgrading from public housing, sentiments on home prices, and the timeframe in which respondents perceive they might realistically be able upgrade to a private home. They were also asked about the affordability and relevance of executive condominiums (EC) which will be presented in a separate report in August.

Chart 1: Proportion of respondents and aspirations on upgrading from HDB flat

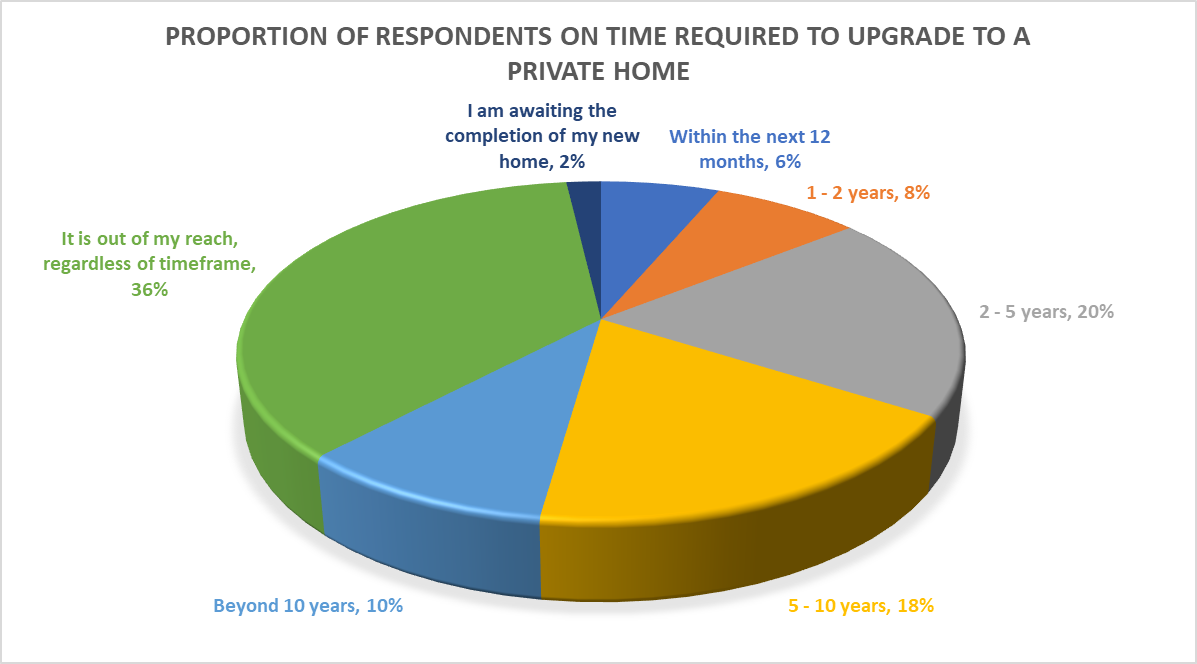

Ismail Gafoor, CEO of PropNex, said, "It is fair to say that HDB flats are a staple of housing in Singapore and will continue to be home to the majority of the population. That said, we know that one of the aspirations of many Singaporean households is to own and live in a private home. Aspirations aside, however, our survey found that a substantial portion of the respondents either felt that they are priced out of the market and will never be able to purchase a private home (36% of respondents), or that it may require 5 to 10 years (18%), or more than 10 years (10%) before they can upgrade to a private home. Only 6% of the respondents said they could upgrade to a private home in the next 12 months (see Chart 2)."

The main challenges cited by respondents for not being able to upgrade to a private home include high home prices and the prevailing additional buyer's stamp duty (ABSD) measure, which require the HDB upgraders to pay the 20% ABSD upfront first (being their second residential property), before applying for an ABSD remission, subject to them meeting the remission conditions.

Mr Gafoor added, "To this end, perhaps the government can consider aligning the ABSD treatment for flat owners wishing to upgrade to a private home, with that of those looking to purchase new ECs from developers. Presently, HDB upgraders buying new ECs do not need to fork out the large ABSD payment upfront, they could live in their existing flat and are required to sell their flat six months after their new EC receives the temporary occupation permit (TOP)."

Chart 2: Proportion of respondents on time required to upgrade to a private home

Meanwhile, high private home prices were cited by about 64% (793 responses) of the respondents as one of the key reasons that deters them from upgrading to a private residential property. Based on the URA property price index (PPI), overall private home prices have climbed for seven straight years since 2017, rising by about 51% cumulatively from Q1 2017 to Q2 2024 (flash estimates).

About a quarter of those polled said that new private residential project launches and resale private homes are extremely unaffordable (see Table 1), while 42% and 38% of the respondents felt that private new launches and private resale homes are unaffordable, respectively. As expected, public housing continues to be the more affordable housing option, particularly the Build-to-Order (BTO) flats offered for sale by the HDB. A combined 37% of the respondents indicated that BTO flats are either affordable or extremely affordable.

Meanwhile, with the prices of HDB resale flats strengthening in recent years, a fairly sizable portion of those surveyed perceived HDB resale flats to be unaffordable (33%) or extremely unaffordable (12%). According to the HDB resale price index, the resale prices of HDB flats rose by a cumulative 43% between Q1 2019 and Q2 2024 (flash estimates), following six years of price decline from 2013 to 2018.

Table 1: Perceptions on affordability of homes in various property segments

Affordability | BTO flats | HDB resale flats | Private new launches | Private resale |

Extremely unaffordable | 5% | 12% | 26% | 23% |

Unaffordable | 18% | 33% | 42% | 38% |

Neutral | 39% | 37% | 25% | 28% |

Affordable | 32% | 16% | 7% | 10% |

Extremely affordable | 5% | 1% | 0.4% | 0.5% |

Wong Siew Ying, Head of Research and Content at PropNex, said, "Given their views that private homes are much pricier, a larger proportion of the respondents said that their next preferred housing type - should they relocate - will be public housing: 23% selected an HDB resale flat; while 21% said they would go for an HDB BTO flat. Meanwhile, 17% of those polled indicated that their next preferred housing option is a new launch condo, 15% would go for a resale condo, and 13% for a new launch EC. The remaining 11% of the respondents opted for either a resale or new landed home, or a resale EC."

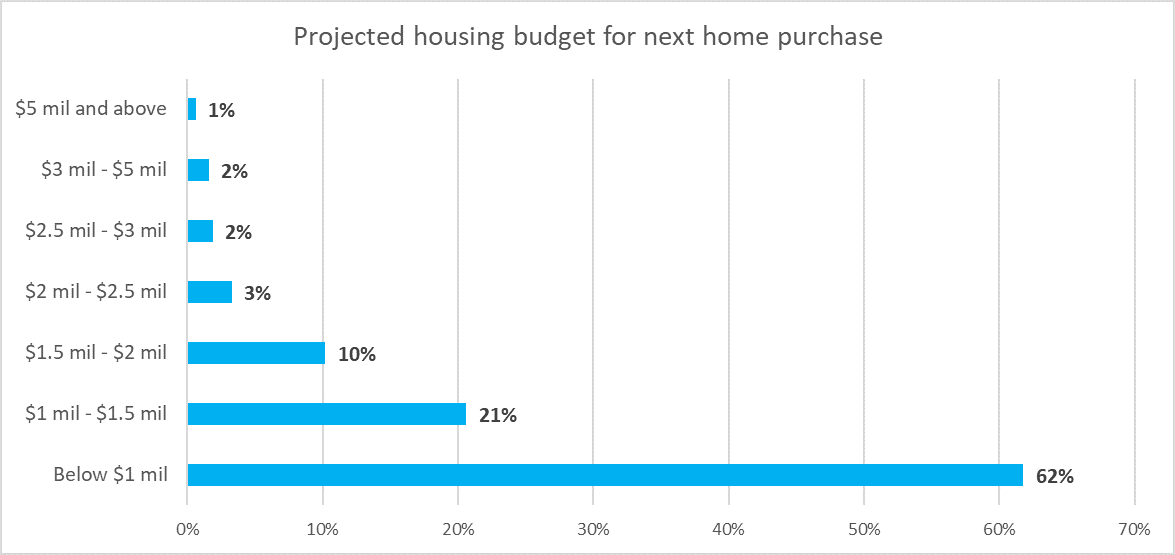

The respondents' choice of next preferred housing type is perhaps reflective of their housing budget. About six in 10 (62%) of the HDB flat owners surveyed said they have a projected housing budget of below $1 million, 21% at a range of $1 million to $1.5 million, and 10% at $1.5 million to $2 million. The rest of the respondents have a projected housing budget of $2 million or more (see Chart 3). At these levels, it would seem that many of those polled may be priced out of the private housing market.

In 1H 2024, the average transacted price of non-landed new private homes (ex. EC) in the Outside Central Region (OCR) was about $1.9 million, while that of resale non-landed private homes (ex. EC) in the OCR was nearly $1.5 million. For new launch EC units, the average transacted price was $1.6 million during the same period, based on URA Realis caveat data.

Chart 3: Proportion of respondents based on their projected housing budget

Over in the HDB resale flat segment, the average transacted price for 5-room resale flats was about $714,000 in 1H 2024, while that of 4-room resale flats was $609,000, and that of executive flats was $861,000, according to transaction data. To this end, HDB resale flats may be seen as more affordable options over private homes for some HDB flat owners looking to relocate.

"The high cost of buying a replacement home, in turn has a bearing on the asking price set by HDB flat owners for their flat on the resale market. Survey findings showed that 56% of the respondents will not sell their flat at a discount to the market price. In a separate question on the price premium that they seek in the sale of their flat, nearly one-third of the respondents are expecting a 5% to 10% premium, 21% of them seek a 10% to 20% price premium, while 16% of those polled are looking at fetching a premium of more than 20% over the market price from the sale of their flat," Ms Wong said.

Meanwhile, it may be inferred from survey findings that many flat owners see their HDB flat primarily as a home, and are perhaps in no hurry to sell their flat. About 74% of the respondents either agree or strongly agree that their present HDB flat meets their housing needs adequately. When asked about how they view their HDB flat, the most cited response was that it is a roof over their heads - an option selected by 976* respondents - followed by 343* responses for the HDB flat being a retirement nest egg, and 218* responses that an HDB flat is a tool to help build wealth. The two options that drew the fewest responses were HDB flat as a legacy asset to hand to the next generation (198*), and HDB flat as a store of wealth (189*), possibly stemming from some uncertainties on the effects of lease decay on the flat value over the long-term.

Read the full report here.

PropNex will release the survey findings report on the EC market in August.