PropNex Picks

|April 16,2025Is It The Right Time To Buy CCR Homes Now?

Share this article:

Sales momentum in the Core Central Region (CCR) sub-market has been modest over the past couple of years. This was a result of a combination of factors including the high interest rate environment, muted market sentiment and cooling measures curbing demand for high-end properties. To that end, it has resulted in sluggish sales and an uptick in unsold inventory in this market segment.

The focus of some property investors and opportunistic buyers has shifted to searching for "hidden gems" or value-buys in the CCR. With CCR home prices rising at a slower pace and some projects offering promotions to entice buyers, a new trend seems to have emerged - a narrowing price gap between CCR and non-CCR homes.

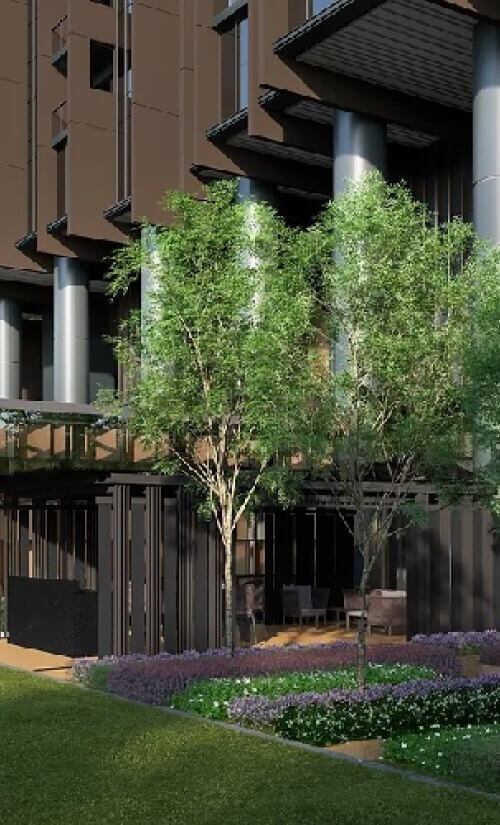

An analysis of recent sales data has pointed towards a record low price gap between CCR homes and that of properties in the Rest of Central Region (RCR) and Outside Central Region (OCR). For new launches, the CCR-OCR average unit price gap declined to a record low of 21.2% in Q1 2025 (see Chart 1). Meanwhile, the CCR-RCR price gap has also narrowed to an all-time low at 4.5%. This is the narrowest gap since Q1 2013, when the CCR-RCR price gap dipped to 4.8%.

In the resale market, both CCR-RCR and CCR-OCR average unit price gaps have touched recent lows in 2024. In Q3 2024, the CCR-RCR price gap narrowed to 17.6%, the lowest since Q4 1999, where the CCR-RCR price gap stood at 19.1%. Meanwhile the CCR-OCR price gap eased to 45.8% in Q2 2024 - a 23-year low since Q4 2001 where the CCR-OCR price gap was at 43.9% (see Chart 2).

With the price gap between CCR and RCR/OCR homes continuing to narrow, some astute buyers may be on the prowl for value-buys in the prime areas. This then begs the question: Is it the right time to enter the CCR market now? Arguably, yes-given current market conditions, developers and CCR resale property sellers will be sensitive about pricing, which offers buyers and investors a rare window of opportunity to buy into this high-end luxury homes segment.

In a nutshell, the narrowing price gaps stem from what has become a two-speed private housing market - with the CCR segment growing at a slower pace than the other two sub-markets. Based on the URA property price index (PPI) flash estimates, non-landed private home prices in the CCR rose by a cumulative 18.8%, while that of the RCR and OCR jumped by 47.9% and 45.7%, respectively between Q1 2020 and Q1 2025, since the pandemic.

A cocktail of factors also weighed heavier on the CCR. Considering the higher price quantum of CCR homes, the sharp run-up in mortgage rates to more than 4% p.a. - after the US Federal Reserve hike rates from 2022 to combat inflation - did the CCR no favours. While it is true that interest rates have since moderated, there are other issues dragging on the CCR - chief among them, the additional buyer's stamp duty (ABSD).

It has been said that of the three sub-markets, the CCR tends to see a greater share of interest among foreign buyers and investors, who are drawn to luxurious, large-format units typically in the prime districts. Well, the doubling of the ABSD rate to 60% in April 2023 dealt another blow to foreign investment demand, as few buyers are ready to shell out the hefty ABSD tax, particularly if the CCR property they are keen on is in a higher price tier. The tightening of the ABSD measure in April 2023 was the fourth revision since it was introduced in December 2011.

Some foreigners are eligible for ABSD remission under various free trade agreements with Singapore (nationals and PRs of Iceland, Liechtenstein, Norway or Switzerland; nationals of the US) and are accorded the same tax treatment as Singaporeans. But let's face it, any demand from these prospective buyers is unlikely to completely offset the decline in investment interest from foreign buyers from the other countries.

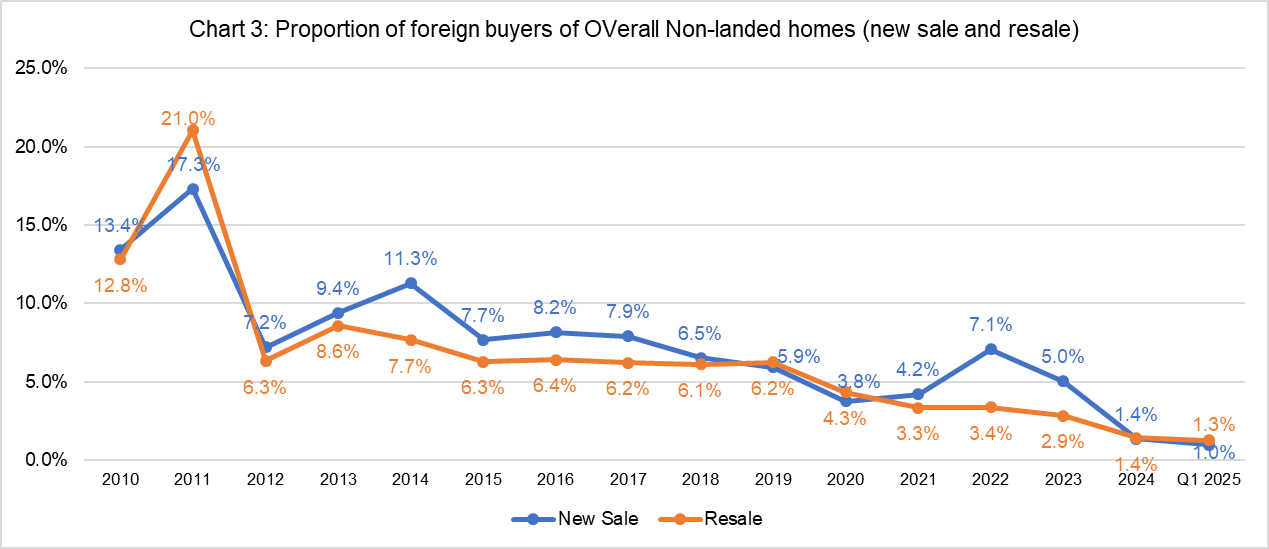

The proportion of foreigners buying non-landed new and resale private homes in Singapore declined significantly from April 2023, slumping to a new low of 1% and 1.3% respectively in Q1 2025 (see Chart 3), compared with 7.1% (new) and 3.4% (resale) in 2022.

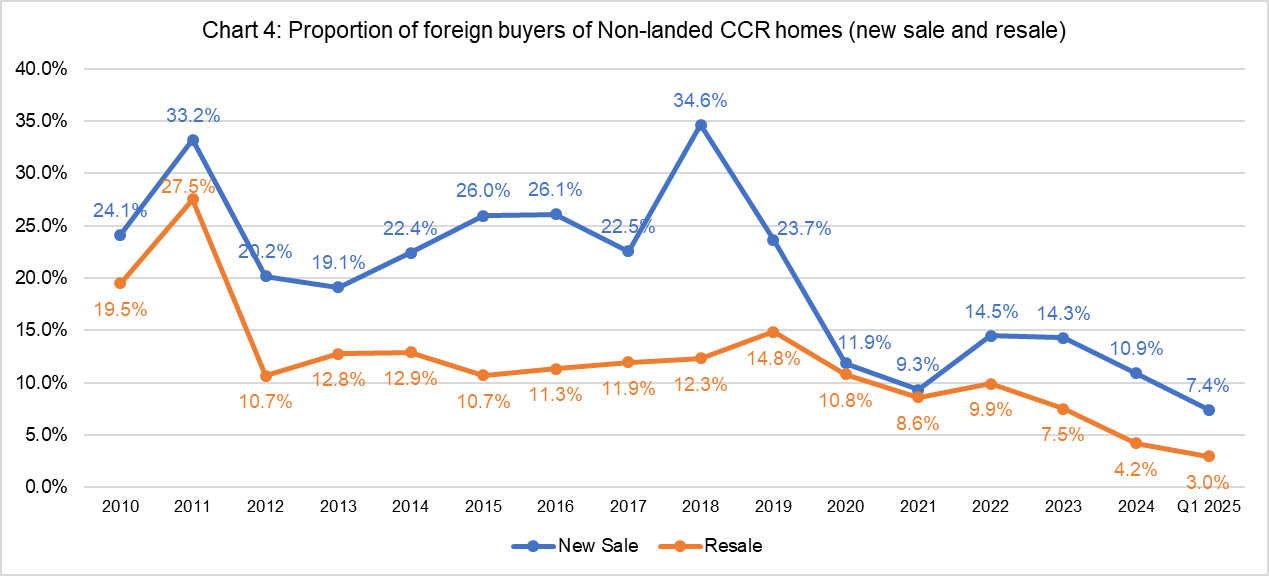

Zeroing in on the CCR segment specifically, the proportion of foreign buyers who purchased new non-landed private homes fell from 14.5% in 2022 to 7.4% in Q1 2025. Similarly, the portion of such buyers in the CCR resale non-landed homes market slipped from 9.9% in 2022 to 3% in Q1 2025, as per caveats lodged (see chart 4).

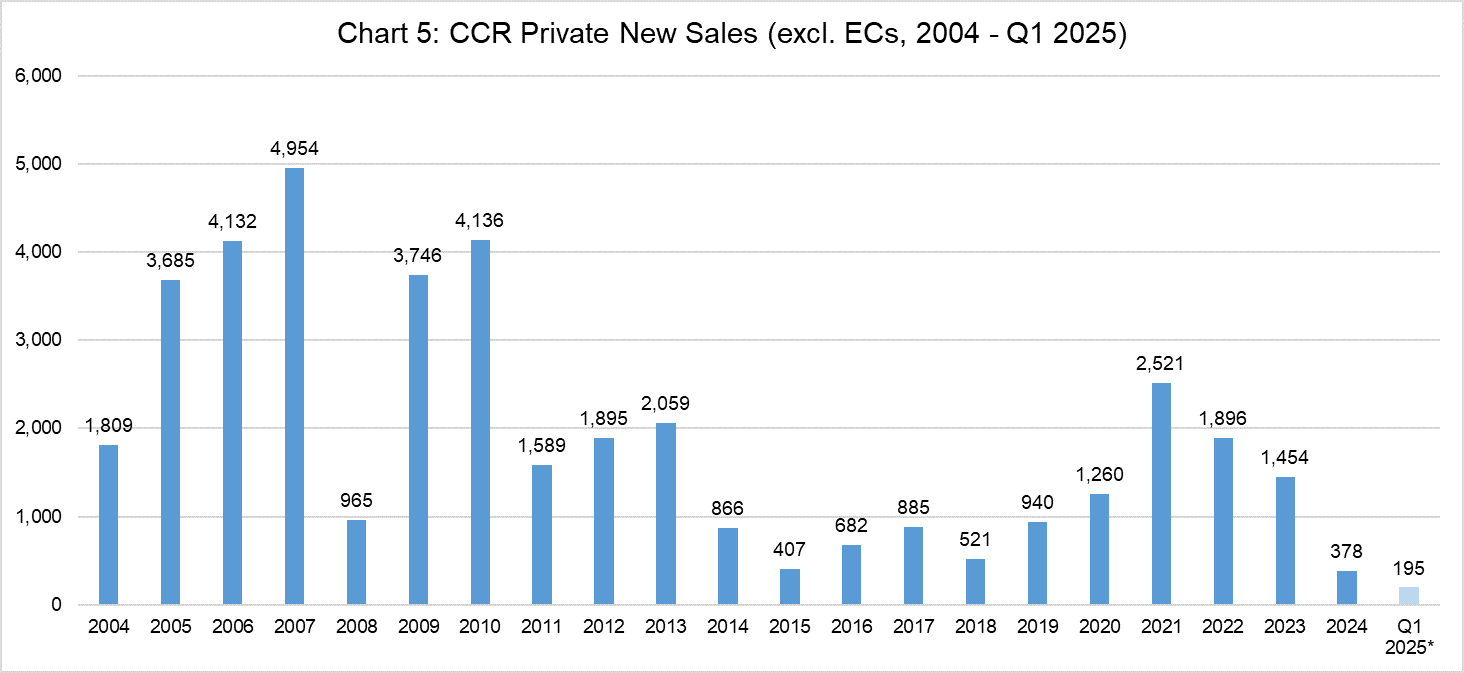

To be sure, compared with the RCR and OCR, the CCR already sees a smaller demand pool to begin with as many owner-occupiers prefer the city fringe and the suburban areas - the punitive ABSD rate on foreigners only reduced it further. Undoubtedly, market sentiment has been affected and CCR developers have held off on launches. This then contributed to weaker sales in the CCR. The annual new home sales in the CCR fell to a record low of 378 units for the whole of 2024 (see chart 5).

Source: PropNex Research, URA (*data retrieved from URA monthly developer's sales report)

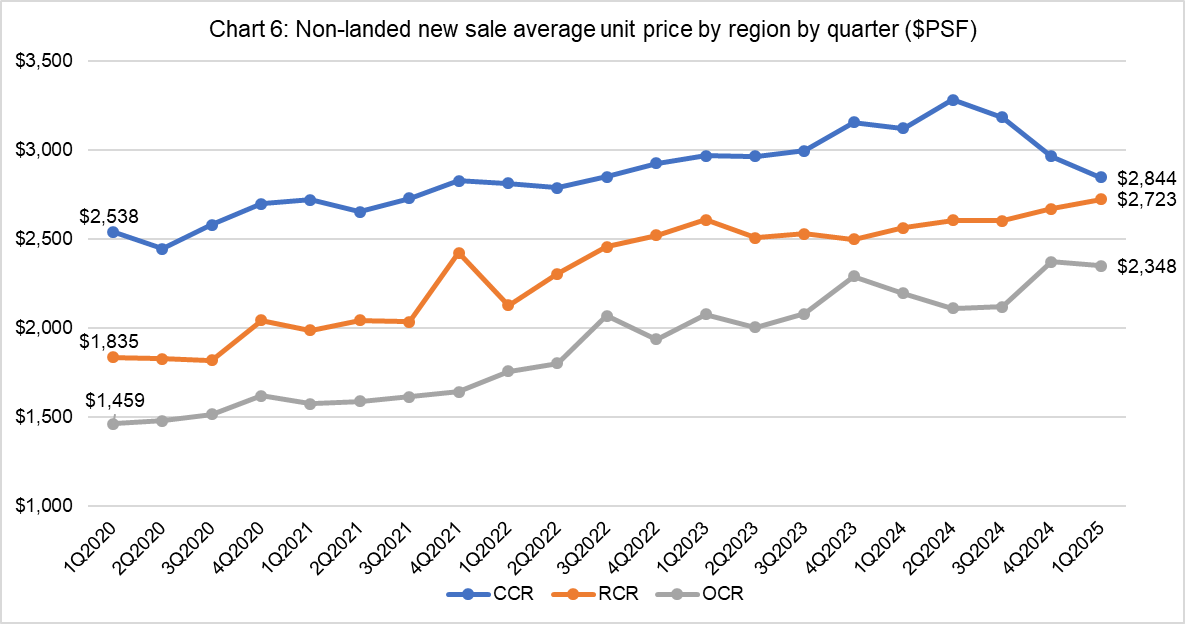

New launch prices in the CCR grew at a significantly slower pace compared with other regions. From Q1 2020 to Q1 2025, the average unit price of CCR non-landed new sales grew by 12.1% from $2,538 psf to $2,844 psf. Meanwhile, that of RCR and OCR non-landed new homes climbed by 48.4% and 60.9%, respectively over the same period (see chart 6).

Source: PropNex Research, URA Realis

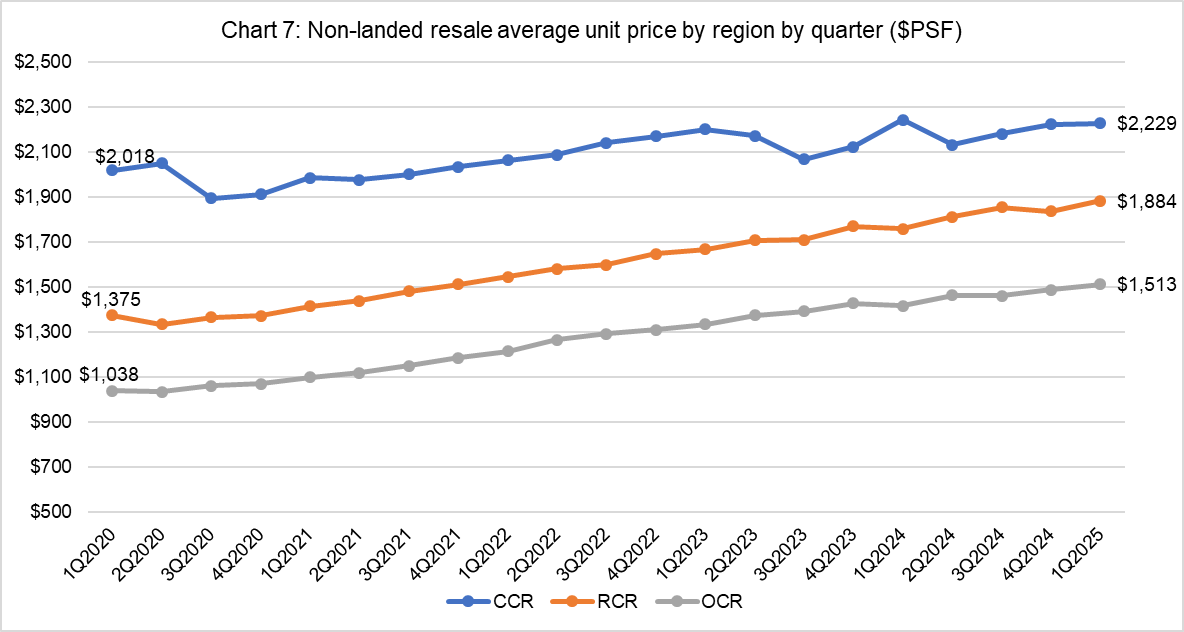

A similar observation can be made for resale homes. From Q1 2020 to Q1 2025, the average unit price of CCR non-landed resale homes rose by 10.4% from $2,018 psf to $2,229 psf. Meanwhile, that of RCR and OCR non-landed new homes grew by 37.1% and 45.8%, respectively over the same timeframe (see chart 7).

Source: PropNex Research, URA Realis

On the whole, market sentiment has somewhat dipped in early-April 2025, following the announcement of sweeping tariffs by the US on its trading partners, as well as the escalating trade tensions between the US and China. This has roiled financial markets and heightened caution across the world. As the property market is sentiment-driven, the downside risks and uncertainties brought about by the tariffs may influence property purchase decisions, particularly among investors.

With cooling measures still in place, PropNex expects that foreign buying interest in CCR properties may remain muted. This could present opportunities for local buyers to explore options in the CCR, as more new projects are slated to be launched in 2025. Typically, developers tend to price units more attractively over the launch weekend to drive the sales momentum, and prospective buyers could potentially gain a first-mover advantage by purchasing a rightly-priced unit directly from developers. Some exciting CCR projects that may come on this year include those in Orchard Boulevard, River Valley, Marina View, and Holland Drive.

Speak to a PropNex salesperson to uncover potential growth opportunities in the CCR housing market today.

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position. No part of this content may be reproduced, distributed, transmitted, displayed, published, or broadcast in any form or by any means without the prior written consent of PropNex.

For permission to use, reproduce, or distribute any content, please contact the Corporate Communications department. PropNex reserves the right to modify or update this disclaimer at any time without prior notice.